Thailand is well known as a beautiful country filled with friendly people - the ‘Land of Smiles’. Given this well-deserved reputation, it may come as a surprise that Thailand is also well known in Asia trade compliance circles for very tough customs authorities.

To celebrate the opening of Tradewin Thailand, we wanted to highlight the top 3 reasons for import clearance delays.

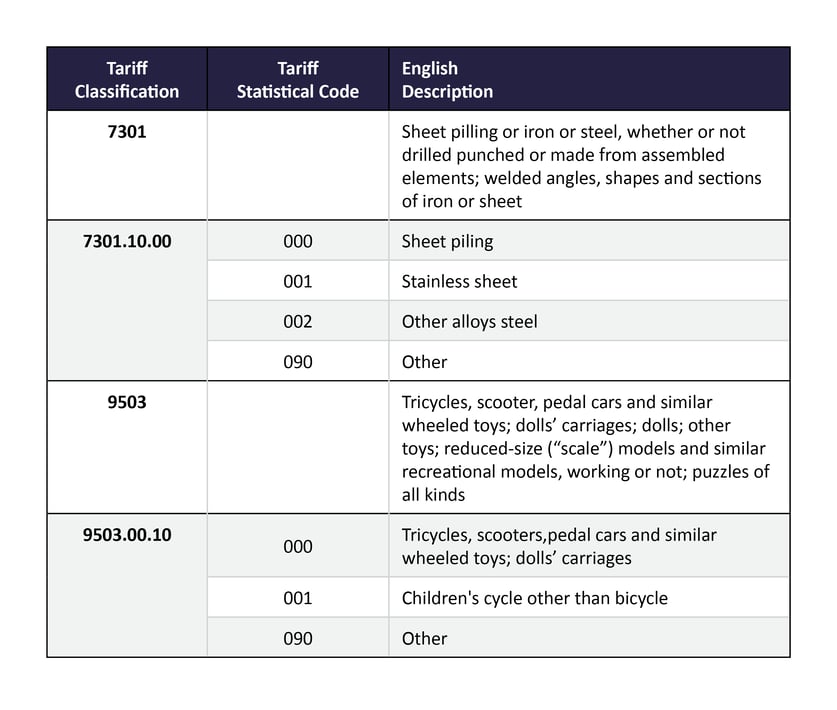

- HS code classification to the Thailand 11-digit tariff

The HS code of goods in Thailand is an 11-digit code. The first 8-digits are known as the ASEAN Harmonized Tariff Nomenclature (AHTN) code. The AHTN is harmonized at the 8-digit level across all ASEAN member countries. The final 3-digits are used in Thailand to further define specific types of goods that are subject to import/export controls, such as permits or licenses.

For example:

A few things to note in this regard:

Often times to get to the right 11-digit code, it is necessary to provide details such as function, photos or drawings; power consumption; energy type; etc. While this can be time consuming, waiting until time of entry opens the door to staff potentially making non-compliant decisions in order to avoid clearance delays.

In many cases, the information available to a customs broker in Thailand on the shipping documents is not going to be sufficient to figure out this 11-digit national code. To avoid misclassification and potential violation of import licensing requirements, do not wait until the time of import to determine the proper Thailand national code.

Keep in mind that Thai Customs issues many Advanced Classification Rulings, it is wise to take these into consideration when determining the applicable Thailand code. Blanket assumptions that US Customs interpretations will apply are risky. - Commodity name on invoice and entry form

All import or export procedures in Thailand require the submission of a Customs' import/export entry form. This document must be accompanied by standard shipping documents (commercial invoice, packing list, bill of lading or airway bill).

Under the e-import system, all data is transmitted electronically from an importer computer system to the e-Customs system. Often the product name in Thai that importers or exporters use is not clear to Customs.

This can be because the name used is based on a PO or on a Bill of Material (BOM), which is meant for internal usage. It is very common for shipments to be delayed due to Thai Customs asking for clarifications on the exact nature of the product. This may then often lead to Customs concerns about the HS classification as well.Importers and exporters should ensure the product names that are being declared are sufficiently descriptive. Best practice would be to determine the applicable product name in Thai to be declared at the same time as the Thailand national HS classification, well before the time of import.

- ‘Fair market value’

Like all WTO countries, Thailand’s customs valuation rules are based upon the WTO Customs Valuation Agreement. In most cases, customs value should be based on the actual price paid or payable (transaction value) with additions (such as international freight, royalties, etc.) where required.

In practice, Thailand Customs will compare declared import values against a ‘fair market value’ database, which it has compiled of declared values across HS codes over the past several years. If the value declared differs substantially (generally about 10%) from the database, the entry may be flagged and Customs may require the Importer to provide supporting evidence as to why its price is justified. This can result in entry delays, as generally the valuation matter should be resolved prior to the release of the cargo.

To sum it up, remember that Thailand is one of the most enforcement minded Customs authorities in the world. However, many of these hurdles can be overcome with a little bit of preparation upstream to ensure your HS Codes are correct, your descriptions are accurate, and you valuation is properly determined.

If you need help, give Tradewin Thailand a call. We are here to help.